London Capital Group (LCG) is a UK-based brokerage firm that provides online trading services to traders worldwide.

- Over 20 years of experience with a license from the Financial Conduct Authority (FCA)

- 7000+ assets across 9 different classes

- A superior trading app on Google Play or the App Store

- 24/5 support service on email, phone, and live chat

- Advanced trading tools for professional clients

- £100 minimum deposit requirement

- Limited learning resources

- Limited deposit and withdrawal options

- Lists forex and CFD assets

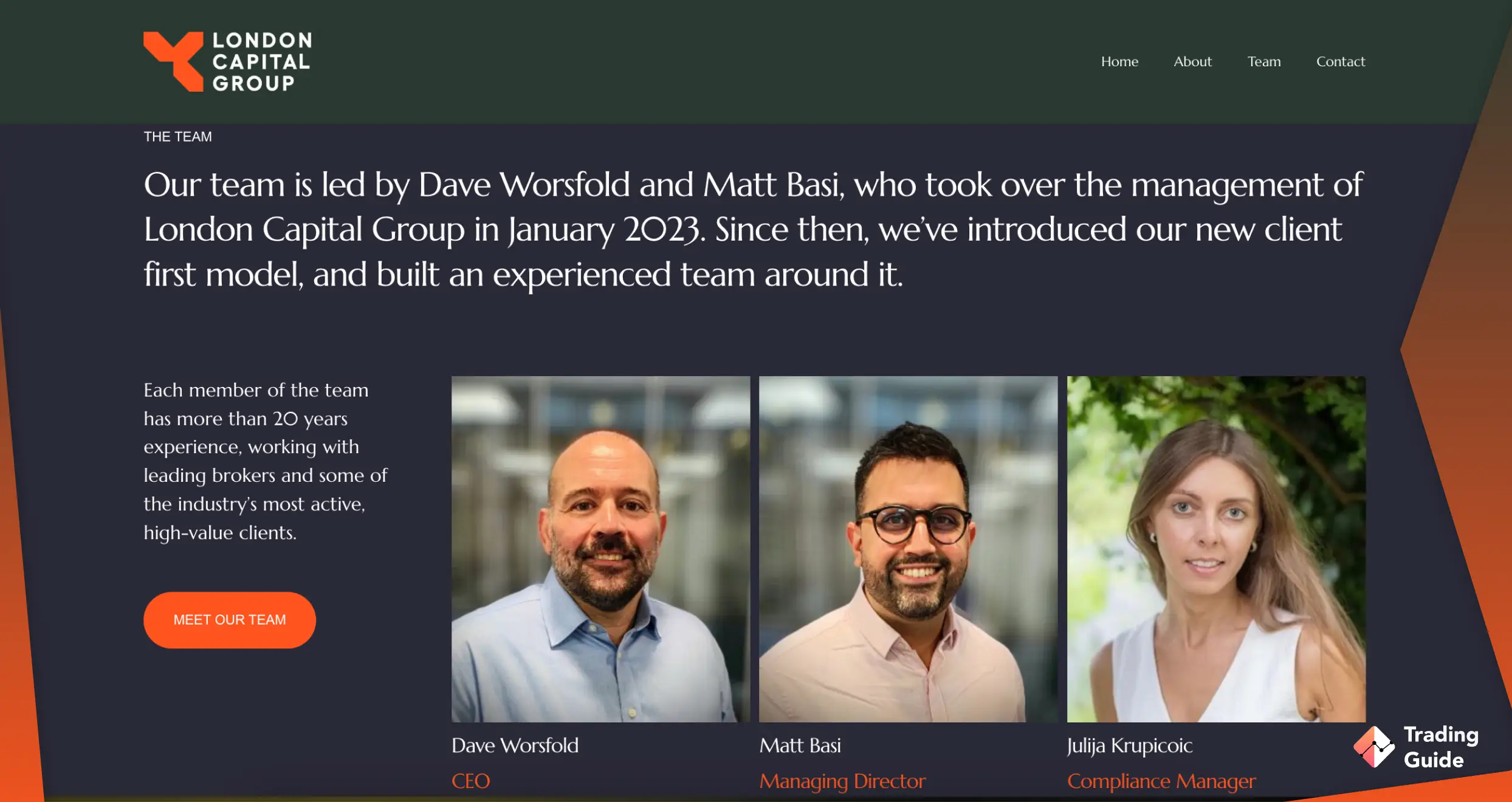

London Capital Group (LCG) is a UK-based brokerage firm that provides online trading services to traders worldwide. Founded in 1996, LCG has established itself as a well-respected and reputable trading platform, offering a wide range of trading products, including forex, stocks, indices, and commodities. With more than 20 years of experience in the financial markets, LCG has built a strong reputation for its reliability, transparency, and customer service.

We have prepared this review to closely examine LCG’s trading platform, trading conditions, customer support, regulatory status, and more. This is so that you can easily decide if it is the right broker for your trading needs.

LCG – Who Are They?

London Capital Group (LCG) is an award-winning forex and CFD trading broker that has been existing since 1996. Headquartered in London, the company is publicly listed on the London Stock Exchange under the ticker LCG. It is also regulated by the Financial Conduct Authority (FCA), one of the most reputable financial regulators in the world.

London Capital Group offers access to over 7000 markets across 9 different asset classes, including forex, commodities, shares, indices, bonds, options, ETFs, and cryptocurrencies. You will also enjoy a seamless trading experience through its web and mobile trading platforms, thus increasing your profit potential.

Overall, London Capital Group is a user-friendly broker with reliable support service. Its advanced LCG Trader and MetaTrader 4 (MT4) platforms offer a range of advanced tools and features for maximum experience. There is also the ECN (Electronic Communications Network) trading feature, which allows traders to trade directly with other market participants rather than through a dealing desk.

Compare LCG Features With Other Brokers

Compare brokers

Licenses and Security

London Capital Group (LCG) is a regulated and secure online trading platform that provides its clients with a safe trading environment. The broker is licensed and regulated by the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas. Simply put, LCG is held to high safety and security standards for customer funds and trading practices.

In addition, LCG provides additional asset protection to its clients through the Financial Services Compensation Scheme (FSCS). The FSCS is a UK government-backed scheme that provides up to £85,000 of protection per client in the event that the broker becomes insolvent. Sadly, this broker does not offer two-factor authentication or biometric scanning for login, which may be a concern for some traders.

Assets Offered

London Capital Group offers over 7,000 CFD products to explore and discover diverse investment opportunities. These assets include Indices, Commodities, Forex, Spot Metals, Shares, Vanilla Options, Bonds & Interests, ETFs and cryptocurrencies. This wide range of trading products allows traders to easily diversify their portfolios on a single platform.

Note that traders cannot use this broker to purchase and take ownership of any underlying asset. Instead, you can only trade contracts for difference (CFDs) which allow you to speculate on an asset’s price movements and benefit from the price difference.

LCG Fees and Commission

LCG has a minimum deposit requirement of £0 for their standard account. However, its ECN account requires a minimum deposit of £10,000, which may be a barrier for some traders. When it comes to CFD trading fees, the broker’s spreads are relatively high, and you may end up paying more than you would with other brokers.

Additionally, LCG charges an inactivity fee of £15 per month after 6 months of no trading activity, which can add up over time. On the bright side, deposits and withdrawals are free, except for credit card deposits that attract a 2% commission fee.

| Type | Fee |

|---|---|

| Minimum deposit | £0 |

| Minimum deposit for ECN account | £10,000 |

| Deposit fee | Free, but credit card deposits 2% fee |

| Withdrawal fee | Free, but credit card deposits 2% fee |

| Inactivity fee | £15 |

Deposit and Withdrawal Methods

There is a range of fast and secure payment methods for deposits and withdrawals at London Capital Group. As mentioned earlier, the broker does not charge any fees for deposits and withdrawals, except for credit card deposits that attract a 2% commission fee. You can make deposits and withdrawals using bank transfers, Visa, MasterCard, UnionPay, Skrill, and Neteller.

Note that deposits are processed quickly, and most methods take up to 30 minutes to reflect in your account. However, bank transfers may take up to 24 hours to process. Withdrawals are also processed within 24 hours, ensuring traders can access their funds quickly and efficiently.

LCG also offers traders the ability to hold accounts in different currencies, including GBP, EUR, USD, and CHF. This allows traders to avoid the costs and hassles of currency conversion. Also you can choose the currency that best suits their trading needs.

Platforms and Educational Tools

London Capital Group provides its clients with a range of trading platforms, including LCG Trader and MT4, suitable for all types of traders. The LCG Trader is a multi-asset platform that offers unique resources for strategy development, including advanced charting, technical analysis tools, and real-time news and market data. The platform is also customisable, allowing traders to tailor it to suit their trading needs.

MT4 is another LCG platform available in 39 languages and provides free signals, automated trading, and an advanced charting package. While the learning resources are not as comprehensive as expected, traders can still use online trading videos, webinars, and support guides to boost their skills. There is also a basic FAQ section and a demo account, which enables traders to gauge their skill level and practice trading strategies without risking real money.

How To Register an LCG Account

If you are considering LCG for your trading ventures, you need to start by creating an account with the broker. We list below the simple procedures to note.

- Visit the London Capital Group website using the links we’ve shared on this page.

- Click “OPEN LIVE ACCOUNT” and share your personal details, including your email, current location, and phone number. You should also choose your preferred platform, whether MT4 or LCG Trader and currency to trade with.

- Create a strong password for your account. Check the box underneath to confirm that you initiated the broker’s services for your own interest.

- Click “NEXT” and fill in additional personal information, including your name, date of birth, Nationality, place of birth, physical address, employment status, and financial experience. You should also indicate your experience in trading.

- Agree to the user agreement and terms of use, then click “SUBMIT”.

- Upload documents to verify your shared data. These include copies of your original ID card or driver’s licence and a recent utility bill or bank statement.

- Your account is now ready for deposits and trading.

Editor’s Note

Based on our professional view, London Capital Group is an excellent forex and CFD broker for newbies and expert traders alike. Although it has limited learning resources and a basic FAQ section, beginners can still boost their skill levels with available resources. Plus, the broker has a user-friendly and customisable trading platform that provides users with adequate resources for strategy development.

We also like the fact that LCG has expert traders in mind, thus hosting the MT4 platform with advanced features such as free signals, automated trading, and an advanced charting package. There is also the ECN feature and an Islamic account, thus attracting users from diverse religions. We hope that the broker will someday host physical assets to purchase and take full ownership since you can only trade CFD instruments.

FAQs

Yes. London Capital Group is a good broker since it has been around for over 2 decades. Moreover, the broker has a license from the FCA, thus making it a trustworthy option among UK traders. It also lists 7000+ CFD instruments you can explore and diversify your portfolio with.

Yes. London Capital Group is one of the forex and CFD brokers licensed and regulated by the Financial Conduct Authority (FCA) and the Securities Commission of the Bahamas. With such regulations, rest assured that your funds are secure and you get to trade under the best conditions.

Absolutely. We can confidently say that London Capital Group is a legit broker since many users on Google Play, the App Store and Trustpilot rate it highly. Besides, the broker is highly encrypted to secure your data against unauthorised access.

London Capital Group brokerage firm is a subsidiary of the London Capital Group Holdings plc, a company founded in 1996. The broker is headquartered in London, UK and serves millions of clients across various global regions.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Honestly, London Capital Group gives me that uneasy feeling you get when something looks legitimate on paper but the real user experiences tell a different story. I hate that - it's like meeting someone who seems perfectly nice until you hear what their ex-friends say about them. The whole "20+ years in business" thing should be reassuring, but when I see traders complaining about mysterious slippages and spreads that magically widen at the worst possible moments, it just feels like they're using their reputation as cover for sketchy behavior.